WSNA in Olympia — 2025 Legislative Session

March 28, 2025. In this week’s update – an overall recap of the week, updates on each of WSNA’s legislative priorities, other bills we’re watching, and more

March 31, 2025 • 4 minutes, 41 seconds to read

In this week’s update – an overall recap of the week, updates on each of WSNA’s legislative priorities, other bills we’re watching, and more

With just one month left of the 2025 regular legislative session, the deadline for bills to be voted out of policy committees is Wednesday, April 2nd. After this date, there is a very tight six-day turnaround for bills that have an impact on the state budget to be voted out of fiscal committees by April 8th. This brief window of time means that lawmakers will have to act quickly to ensure that bills with fiscal implications, but are not necessary to implement the budget (NTIB), receive the necessary attention before they can move forward in the legislative process.

On Monday, the House and Senate budget leaders each announced their respective budget proposals. In the Senate, Democrats propose balancing the next two-year budget by delaying expansions to early learning and child care programs, implementing furloughs for state workers, and depleting state reserves to boost funding for public schools, particularly special education. House Democrats, meanwhile, avoid furloughs and tapping into savings. Both budgets are better for working people and families than an all-cuts budget. Like the Senate, the House delays the expansion of early learning and child care programs but allocates approximately $1 billion less in new funding for special education and public school operations.

The Senate revenue proposals are up for a hearing this coming Monday, March 31st. Please email your Senators today and ask them to pass a budget with limited cuts that would impact working families and pass progressive revenue. Learn more about what “progressive revenue” vs “regressive revenue” means.

The House revenue proposals will be heard on Thursday – please stay tuned for a separate action alert to come out early next week on that.

Both the House and Senate budget proposals account for new revenue to address the remaining shortfall. The revenue proposals put forward seek to better align the tax code to reflect Washington’s 21st century economy, rapid growth, and expanding needs, and relieve economic pressures on lower- and middle-income families.

Click here to read more about the Senate revenue proposal, and click here to read more about the House revenue proposal

HB 1162 is scheduled for a public hearing in the Senate Ways & Means Committee on Thursday, April 3 at 1:30pm. Please take action TODAY by signing in PRO of HB 1162 before 12:30pm on Thursday, April 3. We need your help to make sure legislators hear loud and clear that WPV is a priority issue for nurses. With the state's current financial situation, we cannot take for granted this bill will be passed given its small fiscal note. Please take action now and share the action link with others.

Instructions for signing in (please read carefully):

You can sign in support until ONE hour before the start of the hearing, so you have until 12:30pm on Thursday, April 3.

1) Start here.

2) Choose position: PRO

3) Fill out the remaining identifying information, leaving “organization” blank. (Do not put the name of your employer or WSNA here.)

SB 5041 is currently in the House Appropriations committee due to its fiscal note. The bill needs to be scheduled for a public hearing and executive action (committee vote) before the April 8 fiscal committee cutoff to advance to the next stage in the legislative process. We will keep you posted on the next steps.

The bill would allow striking or lockout workers to access UI for up to 12 weeks, leveling the playing field between workers and employers. The bill is effective for 10 years: January 1, 2026 through December 31, 2035.

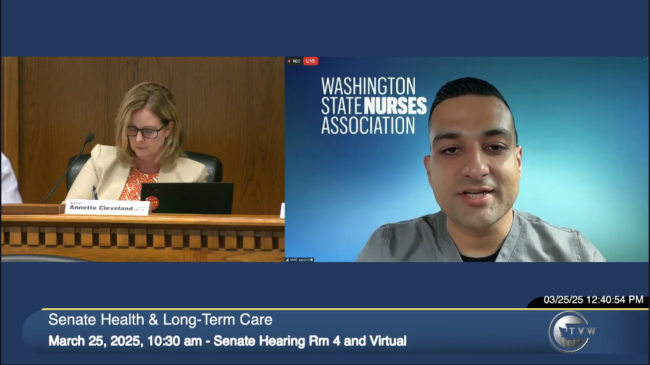

HB 1430 ad a public hearing in the Senate Health & Long-Term Care Committee on Tuesday. WSNA President Justin Gill, who is a practicing NP, testified: “NPs and PAs are highly skilled professions, not a group that should be subject to insurance rate cuts for the purposes of raising revenue for insurance companies.”

The bill was voted out of the committee on Thursday. It may have a fiscal impact on the state’s Uniform Medical Plan, so the bill was referred to Senate Ways & Means to examine further.

Events/Rallies

- Wednesday, April 2 time TBD: Health Care Rally at Washington State Capitol in Olympia. No cuts to healthcare rally. Speakers will include WSNA’s Edna Cortez, Insurance Commissioner Patty Kuderer, State Rep. Natasha Hill, and others.

- Saturday, April 5 at 12-3pm: Hands off Mass Mobilization Events at Seattle Center. This event is about uniting Seattle’s defenders of democracy and includes activities for children and youth. Learn more and register here.

- Tuesday, April 29: Healthcare Defense Day of Action. Stay tuned for more information.

- Find events, petitions, volunteer opportunities, fundraisers and more with AFT.

Upcoming Legislative Milestones

- Week of March 31 – State House and Senate public hearings on revenue proposals

- All of April – State Budget conferencing in the legislature

- April 2 - State Policy Committee Cutoff (Opposite House)

- April 8 - State Fiscal Committee Cutoff (Opposite House)

- April 14 to April 25 – Federal Senate recess

- TBD – State Final Budget Released

- April 27 – End of State Legislative session in Olympia (unless extended into a special session, TBD)

- September 30 – Deadline for Federal Budget

The legislature considers hundreds of bills outside our own legislative priorities. Below is a list of bills we’re watching as they move through the legislative process that may impact members. Click on any of the links to learn more about each bill and where it is in the legislative process.

NEW! HB 2045, investing in Washington families by restructuring the business and occupation tax on high grossing businesses and financial institutions

NEW! HB 2046, creating fairness in Washington’s tax by imposing a tax on select financial intangible assets

NEW! HB 2049, investing in the state’s paramount duty to fund K-12 education and build strong and safe communities

SB 5794, adopting recommendations from the tax preference performance review process, eliminating obsolete tax preferences, clarifying legislative intent, and addressing changes in constitutional law

SB 5795, reducing the state sales and use tax rate

SB 5796, enacting an excise tax on large employers on the amount of payroll expenses above the social security wage threshold to fund programs and services to benefit Washingtonians

SB 5797, enacting a tax on stocks, bonds, and other financial intangible assets for the benefit of public schools

SB 5798, concerning property tax reform

HB 1879, concerning meal and rest breaks for hospital workers

HB 1784, concerning medical assistants

SB 5101, expanding access to leave and safety accommodations to include workers who are victims of hate crimes or bias incidents

HB 1334, modifying the annual regular property tax revenue growth limit

SB 5503, concerning public employee collective bargaining processes

SB 5240, concerning anaphylaxis medication in schools

SB 5493, concerning hospital price transparency

HB 1531, preserving the ability of public officials to address communicable diseases

HB 1308, concerning access to personnel recordsHB 1022, creating a home for heroes program.

HB 1213, expanding protections for workers in the state paid family and medical leave

HB 1069, allowing bargaining over contributions for certain supplemental retirement benefits

HB 1686, creating a health care entity registry

HB 1622, allowing bargaining over matters related to the use of artificial intelligence

HB 1416, increasing tobacco and vapor products taxes

Washington State Labor Council’s 2025 Legislative Priorities